Software composability in crypto

One of the most interesting breakthroughs in crypto is the strong degree of composability the technology lends to software development. Composability is the ability to combine various components of a software stack in different ways. To keep things simple, we’ll split the stack into two parts: front-end and back-end. Applications on the web today, including the likes of Twitter, Amazon, Facebook, both develop and own their proprietary software stack. The primary factors driving the proprietary stacks of today are twofold: closed data structures and monopolistic business models. More user data increases a company’s monetisation potential through strategies such as targeted advertisement and induces strong user lock-ins. As such, web applications are incentivized to monopolize the user experience and software stack. A proprietary front-end provides companies with an avenue to monopolize user experience, while the back-end captures and processes data gathered on users.

Crypto flips this dynamic on its head through both a change in data structure and business model:

- Commoditization of data: blockchains, the technology underpining crypto networks, are open databases that anyone can tap into and build on. While APIs already provide third parties access to centralized databases, the underlying companies decide how their data is exposed and have the power to change the rules at any given time. Blockchains, in contrast, are by design trustless systems, that do not allow for a single entity to arbitrarily change the rules on dependent / higher-order technologies.

- Token-based business model: tokens, the tool to coordinate crypto networks, are a fundamentally new business model that incentivize shared value creation. Tokens of a well-designed crypto network, appreciate in value when more products / services are built atop the network and when it sees increased usage.

A model of shared value creation on open data networks supplants the monopolistic business models spurred by proprietary data silos. A greater degree of composability in software development is enabled by the design of blockchains, and incentivised through a new business model.

Interfaces building on decentralized protocols

When building applications in crypto, teams that work on lower level protocols (back-end), are not necessarily the ones that build the interface (front-end) on top.

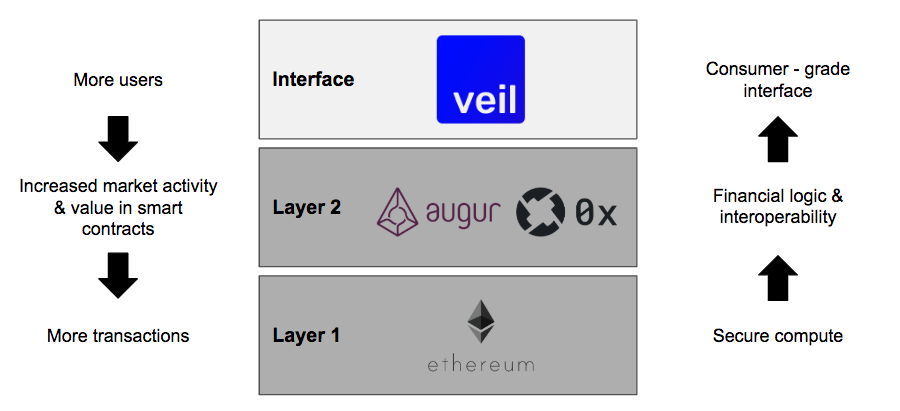

Veil, an interface built on top of the Augur and 0x protocols , is a great example of this in practice. Veil leverages the Augur protocol for handling the logic around prediction markets, and the 0x protocol for trading shares in these markets. The development teams behind these protocols focused their time on building public-good infrastructure that other developers could build on, rather than on an end-user application. The Veil team could leverage both pieces of existing technology freely, and create a product that focuses on end-user experience.

Specialization of software development

Increased composability allows development teams to specialize on a distinct layer in the stack. Teams working on lower level protocols will likely have a different skillset than teams designing consumer-grade interfaces. The ability to leverage pieces of software developed by other teams freely, means that teams don’t have to hire more developers to increase their competency vertically across the entire stack. A team of back-end / smart contract engineers working on lower level protocols can rely on a separate team of front-end engineers / designers to build an interface atop and bring their core technology to market.

As opposed to building on centralized platforms, crypto networks give developers assurances that their infrastructure dependencies won’t suddenly be taken away. This is a boon for innovation as it reduces startup costs even further and induces compounding innovation. Teams can stay smaller and remain focused on their core competency.

Shared value creation across the stack

As technologies start to leverage each other, network effects are triggered that promise to make each component in the stack more valuable.

Looking at how value flows down from the top of the stack, interfaces such as Veil can serve as the point of entry for mainstream users to interact with certain decentralised technologies. More users on Veil, increase the total value that flows into the Augur network through increased activity on existing markets, and the creation of new markets. An uptick in activity and number of markets raises the open interest on the Augur platform and the fees that potentially accrue to holders of Augur’s native token, REP. What follows is an increase in the demand for REP and subsequently price. Ethereum is the base computing chain that timestamps the transactions that occur.

From a bottom up perspective, Ethereum provides a secure computing platform for others to transact and build on. The Augur and 0x protocols provide the financial logic (prediction markets and exchange) as well as a degree of interoperability. Interoperability refers to how open protocols provide shared experiences for technologies built on top, such as shared liquidity pools between different interfaces. With available back-end infrastructure that is open to build on, interfaces can be developed on top that provide feature-rich, consumer grade experiences to mainstream users.

Each layer in the stack needs the others to thrive, as interfaces and protocols form a symbiotic relationship: interfaces rely on protocols for the underlying logic and security, while protocols need interfaces to drive mainstream adoption.

Going Forward

This new paradigm of software development induces a greater division of labor which will result in smaller and more focused teams building out their layer in the stack. On the interface layer, this doesn’t necessarily mean that the business opportunity anywhere will be smaller, but the factors of differentiation will. Monopolizing user experience and building large datasets will no longer crown the winners. New business models will be developed as users will have more leverage in choosing the product / service they want to engage with and experience virtually zero switching costs. Ultimately this will re-vitalize bottom up innovation. Startup costs have been reduced even more. A team of designers can create a financial product that reaches millions of users on top of existing open infrastructure.

Originally published on Hacker Noon