DeFi is real business

DeFi is evolving from a set of financial toys into a sustainable financial system. In an industry like crypto, where new and shiny narratives tend to get prioritised over existing ones, this evolution can go unnoticed. However, in my opinion, it’s one of the most important and perhaps underrated developments in crypto, and one that should serve as inspiration for newer sectors of the space.

Below are some of the figures that tell the story.

Protocols generate significant revenue

Metrics like TVL (total value locked), volume and fees have traditionally been used to evaluate the health of DeFi protocols that generated little, if any revenue. That’s changing.

First, it's important to understand the difference between fees and revenue in a DeFi protocol. Fees represent the total amount users must pay to use a protocol, whereas revenue refers to the portion of that amount a protocol keeps for itself. For instance, in a lending protocol, fees encompass all the interest payments borrowers make to lenders, while revenue is a percentage of the total interest payments that the protocol retains.

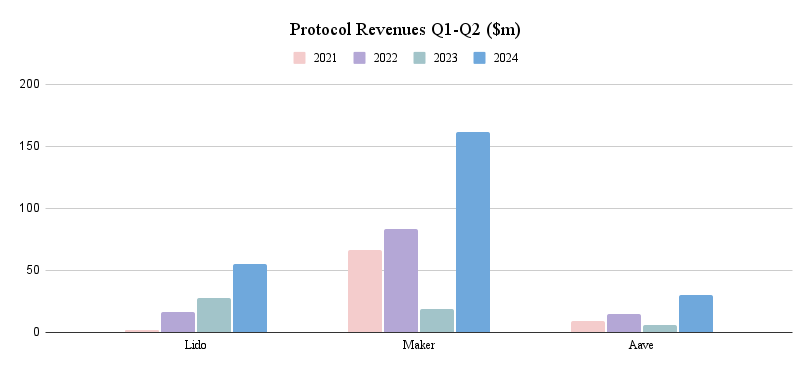

Let’s take a look at the revenues of three of the most important DeFi protocols: Lido, Maker and Aave.

Lido allows ETH holders to earn staking yield without the hassle of staking themselves. It functions as a marketplace, connecting ETH holders with service providers who handle the technical and operational aspects of staking. In exchange, these providers charge a percentage of the staking yield and, for facilitating these connections, Lido takes a 5% cut.

Maker is a stablecoin issuer that allows users to mint its USD-pegged stablecoin, DAI. The revenue Maker generates is the interest users pay while minting (i.e. borrowing) DAI. As there is no other counterparty on Maker (there are no third party lenders), fees = revenue.

Aave is a lending marketplace that matches lenders and borrowers of a range of crypto assets. Fees represent the total interest paid by borrowers to lenders, while revenue is the portion of these fees that the protocol retains.

All these protocols experienced a significant revenue increase over a four-year period. Although Maker and Aave saw revenue decline last year due to reduced usage in a market downturn, the overall upward trend for all protocols is clear.

Annualising their H1 2024 revenues, we get:

- Lido = $110m

- Maker = $324m

- Aave = $60m

Interfaces [also] generate revenue

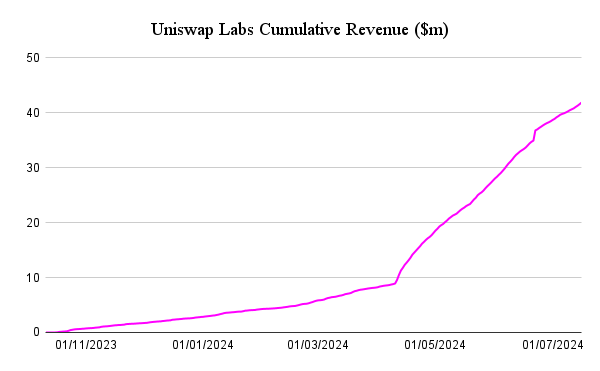

Uniswap, a decentralised exchange, took a different path to generate revenue.

Uniswap, the protocol, generated over $500 million in fees during the first two quarters of this year. While fees are paid to liquidity providers by users who trade on the protocol, the protocol itself has never taken a cut.

Instead, Uniswap has been monetized through Uniswap Labs, a company set up to develop the Uniswap protocol and related tools. One such tool is the Uniswap trading interface, which serves as one of several interfaces for trading on the Uniswap protocol.

Of course, Uniswap Labs has an advantage in that it serves as the core developer of both the interface and protocol, an obvious symbiosis, but users are free to use whichever interface they want.

Since starting to charge users a trading fee late last year, Uniswap Labs has generated over $40 million in revenue and is on track to achieve annualised revenues exceeding $100 million.

Composability is more than a meme

Composability is a core property of DeFi that enables developers to build on other protocols without needing permission. It’s often brought up as a meme, but it’s more than that. It’s a property that can generate real business value.

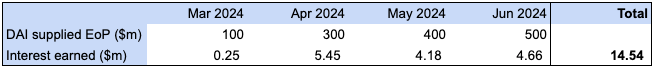

Maker’s integration with Morpho is an example of this. Morpho is a lending protocol that allows third parties to operate lending strategies on top of it. There are currently 41 lending strategies developed by 7 independent third parties on Morpho.

One of these third parties is Maker, which operates a lending strategy that allows users to borrow DAI by posting the appropriate collateral. Between the launch in March and the end of Q2 in June, Maker generated approximately $14.5m in interest payments through this integration alone.

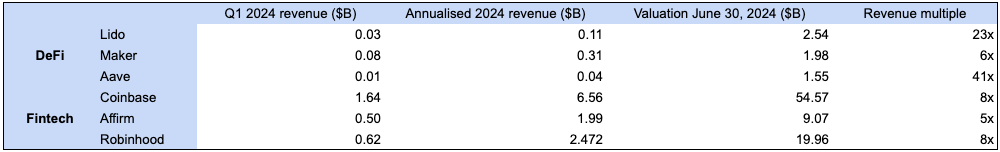

Valuations based on fundamentals

So far, valuations for crypto protocols have primarily been driven by hype and social signalling. This is largely because there haven't been any revenues to base valuations on. A consequence of DeFi protocols generating revenue, is that they can start to be valued through traditional valuation methodologies.

One of my partners Yannis built a comprehensive model for Maple that can be found here. Token Terminal also does a good job in putting together financial statements for a range of different protocols.

Below is a simple table that compares the revenue multiples of three DeFi protocols to publicly traded fintech companies.

While we can debate whether the revenue multiples over or undervalue a DeFi protocol, the point is that we can now base these discussions on actual numbers. This is important because it allows the industry to converge on more objective valuations, which helps boost investor confidence and directs capital to the most deserving projects over the long term.

We are already seeing the introduction of fundamentals-focused investors such as Theia and Modular in the market. As DeFi continues to mature and protocols start prioritising profitability over revenue growth, we can expect the emergence of even more such funds.

DeFi has and continues to be one of the forebears of the crypto industry. While there is still some way to go, the journey so far should serve as an example to other sectors of crypto, that with time and effort, the creation of real businesses is possible.